Coverage security is a type of things that we often forget about until eventually we actually need it. It really is the security Web that will capture us when lifestyle throws us a curveball. No matter whether it's a unexpected medical emergency, a vehicle accident, or harm to your own home, insurance policy security makes certain that you're not remaining stranded. But, what precisely does it mean to acquire insurance plan defense? And just how Are you aware in case you are genuinely included? Let's dive into the globe of insurance coverage and explore its several aspects to assist you understand why it's so vital.

The Only Guide for Insurance Solutions

First, let’s speak about what insurance policies safety definitely is. It’s basically a contract in between you and an insurance company that guarantees economical support from the party of a reduction, problems, or personal injury. In Trade to get a regular or once-a-year top quality, the insurance company agrees to deal with specified hazards that you might deal with. This protection offers you relief, realizing that If your worst comes about, you won’t bear the whole economical load by yourself.

First, let’s speak about what insurance policies safety definitely is. It’s basically a contract in between you and an insurance company that guarantees economical support from the party of a reduction, problems, or personal injury. In Trade to get a regular or once-a-year top quality, the insurance company agrees to deal with specified hazards that you might deal with. This protection offers you relief, realizing that If your worst comes about, you won’t bear the whole economical load by yourself.Now, you could be contemplating, "I’m healthful, I generate thoroughly, and my home is in great form. Do I actually need coverage defense?" The truth is, we will never ever forecast the future. Mishaps come about, illness strikes, and pure disasters arise without warning. Insurance coverage protection acts as a safeguard versus these unforeseen gatherings, assisting you manage expenses when issues go wrong. It’s an financial investment in your upcoming properly-remaining.

Just about the most common varieties of insurance security is overall health coverage. It handles professional medical fees, from program checkups to crisis surgical procedures. Without having well being coverage, even a brief healthcare facility keep could leave you with crippling clinical charges. Well being insurance policies helps you to entry the treatment you will need without stressing with regards to the money strain. It’s a lifeline in moments of vulnerability.

Then, there’s car insurance coverage, which is an additional critical type of protection. No matter if you're driving a brand-new vehicle or an older product, accidents can transpire Anytime. With car insurance policies, you are covered from the event of the crash, theft, or harm to your car or truck. Moreover, when you are linked to an accident in which you're at fault, your coverage can assist go over The prices for one other celebration’s motor vehicle repairs and clinical charges. In a method, car insurance plan is like a shield guarding you from the consequences from the unpredictable street.

Homeowners’ insurance coverage is another essential kind of safety, particularly when you possess your own private home. This protection safeguards your assets from a variety of pitfalls, which includes fireplace, theft, or purely natural disasters like floods or earthquakes. Without it, you might experience monetary spoil if your house ended up being wrecked or severely broken. Homeowners’ coverage not just addresses repairs, but will also supplies legal responsibility defense if somebody is injured on the residence. It is an extensive safety Web for your home and every thing in it.

Existence coverage is 1 space that often will get missed, but it’s just as critical. Though it’s not one thing we would like to think about, lifetime coverage ensures that your family and friends are monetarily guarded if something had been to occur to you personally. It provides a payout towards your beneficiaries, assisting them deal with funeral bills, debts, or residing charges. Existence insurance policy can be a means of displaying your family members Check this link you care, even When you're long gone.

Another form of insurance policy defense that’s getting to be significantly well known is renters’ insurance. Should you lease your home or apartment, your landlord’s insurance may perhaps protect the making itself, however it gained’t go over your personal belongings. Renters’ insurance is pretty inexpensive and might shield your possessions in case of theft, fireplace, or other surprising events. It’s a small investment decision that can help you save from key economic loss.

Though we’re on The subject of insurance coverage, Enable’s not ignore incapacity insurance policies. See what’s new It’s among the lesser-recognised kinds of safety, nevertheless it’s exceptionally important. See what’s new Incapacity coverage offers income substitute in case you turn into unable to operate as a result of ailment or injury. It ensures that you don’t get rid of your livelihood if some thing unpredicted comes about, letting you to definitely focus on recovery with out stressing regarding your finances. For people who count on their paycheck to generate finishes meet up with, disability insurance policies could be a lifesaver.

Now, Enable’s talk about the necessity of selecting the right insurance policies provider. With so many choices on the market, it could be too much to handle to choose the proper one particular for you personally. When deciding upon an insurance company, you would like to be sure they offer the protection you need at a price you could pay for. It’s also important to take into consideration their reputation, customer support, and the benefit of submitting statements. In any case, you want an insurance provider that can have your back whenever you need to have it most.

But just possessing insurance policies defense isn’t ample. In addition, you need to have to be familiar with the conditions of the policy. Studying the wonderful print may not be entertaining, but it’s critical to grasp just what’s covered and what isn’t. Ensure that you fully grasp the deductibles, exclusions, and boundaries within your coverage. By doing this, you can steer clear of awful surprises when you must file a declare. Understanding is electrical power In regards to coverage.

A different component to contemplate is the prospective for bundling your insurance plan insurance policies. Many insurance plan firms offer reductions if you purchase numerous forms of insurance by way of them, for example home and vehicle coverage. Bundling can save you funds though guaranteeing that you've thorough defense in place. So, in the event you’re currently shopping for one particular type of insurance policies, it'd be truly worth Discovering your options for bundling.

Fascination About Comprehensive Business Insurance Solutions

Facts About Insurance Premium Solutions Uncovered

The notion of insurance plan security goes outside of own procedures in addition. Businesses have to have insurance policies way too. For those who very own a business, you probably face pitfalls which can effect your company’s money well being. Enterprise insurance coverage safeguards you from a range of problems, together with house problems, authorized liabilities, and staff-related pitfalls. By way of example, general legal responsibility insurance policies may also help protect your business if a client is injured in your premises. Possessing small business insurance coverage provides the security to function your company with out frequently stressing about what could possibly go Erroneous.

As crucial as it's to get the appropriate insurance plan protection, It can be Similarly crucial to review your insurance policies regularly. Lifetime variations, and so do your insurance plan demands. Should you’ve just lately experienced a newborn, purchased a dwelling, or improved Work, your current guidelines may well not be sufficient. By reviewing your insurance plan defense yearly, you be certain that you’re normally adequately lined for your present conditions. It’s a proactive phase to guard your long term.

Talking of upcoming, insurance plan defense may also be section of your respective long-expression economic technique. Whilst it’s mostly about covering pitfalls, certain forms of insurance coverage, like everyday living insurance coverage, can also function an expense. As an example, some life insurance insurance policies Have got a income price part that grows after a while. Which means Along with providing defense for your personal loved ones, these guidelines could also work as a personal savings automobile for your future.

The bottom line is usually that insurance coverage defense is more than simply a fiscal safety Web – it’s reassurance. It’s understanding that, no matter what comes about, there is a cushion to fall back on. Regardless of whether it’s wellbeing insurance, vehicle protection, or property insurance policy, these policies be certain that you’re not struggling with life’s troubles by itself. With the best insurance policy defense in position, you are able to focus on dwelling your life on the fullest, knowing you’re included when the unpredicted happens.

Ultimately, don’t overlook the significance of staying educated in regards to the evolving world of coverage. As new dangers emerge and restrictions alter, your coverage requirements may well shift. Retaining by yourself educated on the most recent trends and updates will help you make the very best possibilities for your personal or business enterprise safety. In any case, In regards to insurance, information really is electricity. So, take some time To guage your options and ensure that you’re receiving the security you'll need. Your long term self will thank you!

Luke Perry Then & Now!

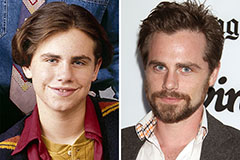

Luke Perry Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Brandy Then & Now!

Brandy Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!